Dual Pricing Program

Dual Pricing Program For Merchants

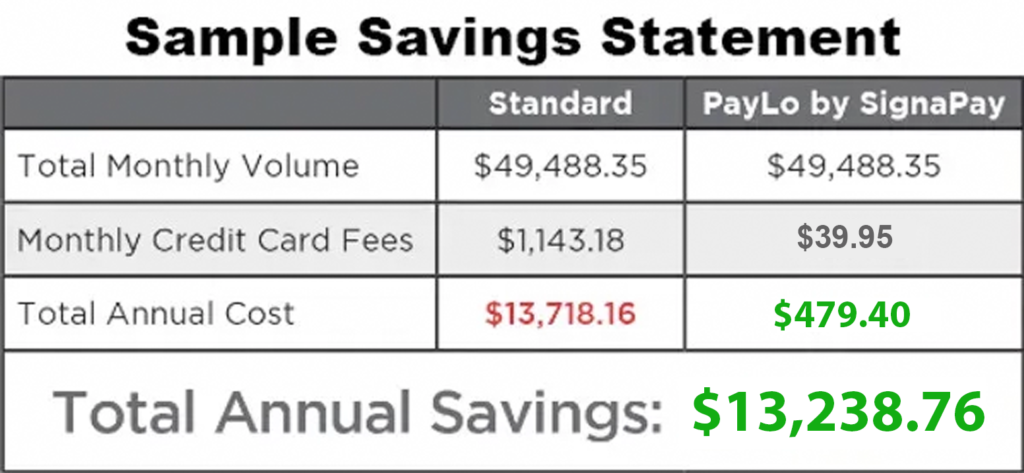

How would you like to only pay $39.95 Per Month with no merchant fees and no contracts? Global 1 Wholesale Merchant Services is here to help. Global 1 now offers a program that gives discounts for merchants called PayLo. PayLo offers a dual pricing program for merchants nationwide by giving them an alternative to standard credit card processing. PayLo eliminates credit card fees and allows merchants to start saving the right way, right away. Ask your Global 1 representative how you can eliminate your credit card processing costs.

A Better Way to Process Payments

Are you looking for a way to accept credit cards and free up more capital each month to put toward your overhead expenses? The Global 1 Dual Pricing Program is the solution for you. Be able to offer a discount to cash-paying customers

.

Is the dual pricing discount program the same as surcharging?

No, the dual price discount program is not the same as surcharging. They seem extremely similar which can make it confusing for merchants. Here is the difference between the dual pricing program and surcharging: Surcharging – Charging a customer an extra fee for paying with a credit card. This is, in essence, disincentivizing the customer to use a card. The dual pricing option – In essence, incentivizes the use of cash.

What about e-commerce businesses?

E-commerce businesses can also benefit from a dual pricing program. While dual pricing programs are typically deployed for in-person transactions, many payment gateways and e-commerce systems can accommodate dual pricing as well. But how is that possible, you may be wondering? Cash can’t be accepted online, so how can I have a dual pricing program for my e-commerce store? Although you can’t take physical cash, you can offer your customers a discount for using ACH or electronic checks (e-checks) for payment, similar to how you can offer a discount for cash payers in person. While a dual pricing program might not be right for all businesses, we believe in giving merchants a choice in the payment acceptance program that best suits their company and customers. Whether this is a traditional program like interchange-plus payment processing, dual pricing program, we have solutions that will help you feel great about accepting payments online and in person.

Dual Pricing FAQs

What is PayLo?

PayLo is a legally patented dual pricing program that was created to offer merchants nationwide an alternative to standard credit card processing. With PayLo, merchants can eliminate their credit card processing costs by offering dual pricing to their customer offering a regular price and a price that rewards the customer who pays cash.

How does PayLo work?

A small customer service fee is added to all transactions. If the customer pays with cash, then the fee is discounted back to the customer.

What is a Dual Pricing Program?

A dual pricing program allows merchant to decrease the price for cash purchases. Dual pricing programs do not discriminate one card over another. Dual pricing rewards customers for paying by a particular means and/or for not using a particular means of payment. Dual pricing programs have been available for years to higher education, municipalities, gas stations and utility providers, but only recently have federal regulations changed to allow independent business owners to use the same programs.

How is a dual pricing different than a surcharge?

A “dual pricing” occurs when a merchant decreases the price for cash purchases. Dual pricing programs do not discriminate one card over another. Dual pricing rewards customers for paying by a particular means and/or for not using a particular means of payment. Dual pricing programs have been available for years to higher education, municipals, gas stations and utility providers, but only recently have federal regulations changed to allow independent business owners to use the same programs.

What benefits can PayLo provide merchants?

With PayLo, you can eliminate your processing fees with virtually no impact on your current sales volume. PayLo is the only legally compliant and patented automatic dual pricing software available in the country and is available for all credit card types, including mobile wallets such as Apple Pay and Android Pay. Even better, this fully mobile payment technology is compatible with wireless terminals as well as POS systems. No PIN Pad is required and an EMV chip card terminal is included.

What type of businesses/industries use PayLo?

PayLo is an ideal solution for a variety of service-based industries including retail, food and beverage, personal services and professional services. Most businesses who use PayLo have an average ticket sale between $10-$75.

Call to sign up for the Cash Discount Program.

Benefits Of Using Global 1 Wholesale Merchant Services

Fast Approval

Get a higher level of service quickly.

No Cancellation Fees

Hassle-free – We handle PCI compliance on our end making sure you provide safe, secure, reliable transactions.

EMV Acceptance

We supply modern credit card machines with all the bells and whistles you expect. EMV, Apple Pay, Google Pay, and contactless payments are all supported..

Online Account Login

Included 24/7 online access to a full suite makes it easy to track your merchant account.

Next Day Funding

No more waiting for deposits. You get next-day funding so you can run your business without all of the unnecessary speed bumps.

No Term Agreements

Our customer service supplies 5-star support!

Free Equipment Program

98% of our merchants qualify for free credit card terminals or processing equipment. Don’t worry about leasing a new machine. We have a new one for you

Exceptional Customer Service

Fully customized & cutting edge, we have low-cost solutions you’ve been looking for.