FAQ’s

Frequently Asked Questions

On this page, you will find information to answer the most common questions surrounding merchant services and payment processing. Our goal is to bring complete transparency to the payment processing industry. Much of the inner workings of this industry are confusing to business owners. We believe that knowledge is power and that all businesses should have an understanding of merchant services and payment processing. We also have some articles on our blog ». Still not finding what you are looking for? Please ask your question in the form below and we will custom-create an information page based on your question.

Why Choose Global 1 Wholesale Merchant Services?

Global 1 Wholesale Merchant Services based in Las Vegas, NV is a merchant services company that is registered directly with Visa, MasterCard, Discover, and American Express. We provide businesses throughout the United States the ability to accept credit cards and take other digital transactions. We have a combined industry experience of over 20 years and have worked on the acquisition, approval, and conversion of billions of dollars in credit card processing volume.

Merchant Services Basics

We provide merchant services payment systems for all businesses. Get a credit card processing system customized for mobile payments, point of sale, e-commerce credit card processing, EMV terminals, and more. We will greatly reduce your merchant services fees while substantially improving the customer service you receive. Browse a credit card processing type below or submit any contact form and a merchant services payment specialist will reach out to start building a relationship.

How Do I Get Support From Contact Global 1 Wholesale Merchant Services?

We are available 24/7 365 days a year. Please reach out to us via phone at 702-248-8900, or submit our contact form for assistance.

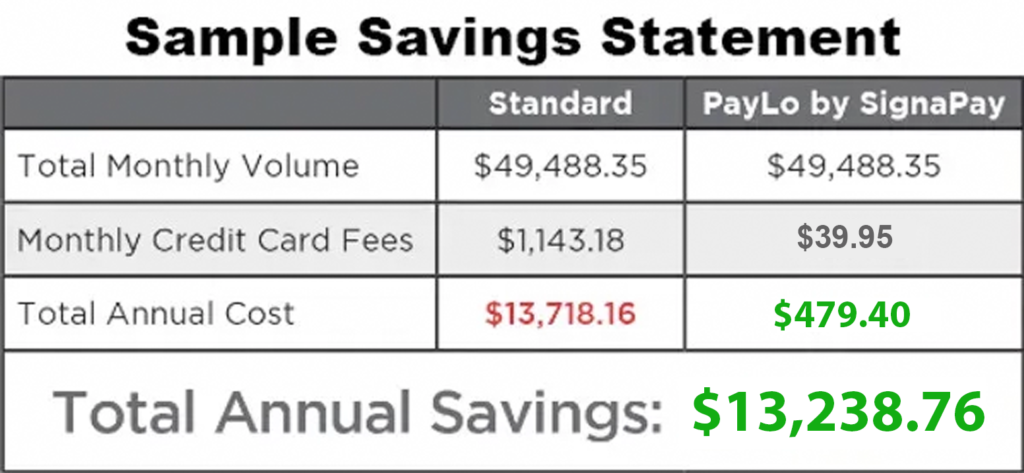

What is PayLo?

PayLo is a legally patented cash discount program that was created to offer merchants nationwide an alternative to standard credit card processing. With PayLo, merchants can eliminate their credit card processing costs by applying a small customer service charge to each sale they make.

How does PayLo work?

A small customer service fee is added to all transactions. If the customer pays with cash, then the fee is discounted back to the customer.

What is a Dual Pricing program?

A dual pricing program allows a merchant to decrease the price for cash purchases. Dual pricing programs do not discriminate one card over another. Dual pricing rewards customers for paying by a particular means and/or for not using a particular means of payment. Dual pricing programs have been available for years to higher education, municipalities, gas stations and utility providers, but only recently have federal regulations changed to allow independent business owners to use the same programs.

How is a dual pricing different than a surcharge?

A “dual pricing” occurs when a merchant decreases the price for cash purchases. Dual pricing programs do not discriminate one card over another. Dual pricing rewards customers for paying by a particular means and/or for not using a particular means of payment. Dual pricing programs have been available for years to higher education, municipals, gas stations and utility providers, but only recently have federal regulations changed to allow independent business owners to use the same programs.

What benefits can PayLo provide merchants?

With PayLo, you can eliminate your processing fees with virtually no impact on your current sales volume. PayLo is the only legally compliant and patented automatic dual pricing software available in the country and is available for all credit card types, including mobile wallets such as Apple Pay and Android Pay. Even better, this fully mobile payment technology is compatible with wireless terminals as well as POS systems. No PIN Pad is required and an EMV chip card terminal is included.

What type of businesses/industries use PayLo?

PayLo is an ideal solution for a variety of service-based industries including retail, food and beverage, personal services, and professional services. Most businesses who use PayLo have an average ticket sale between $10-$75.

What is Interchange Plus Pricing?

Interchange Plus is the common name for a pricing structure for accepting credit card transactions by merchants. The Interchange fee is an important factor in determining the actual cost of accepting credit cards. Interchange pricing is what the Visa and MasterCard associations along with credit card issuing banks charge merchant account providers to process credit and debit card transactions. Merchant Account providers then charge a markup on interchange known as interchange plus pricing to process the transaction and provide customer service to the merchant accepting the credit or debit card payment. Interchange Plus pricing is known as the most honest and transparent form of pricing for merchants looking to accept credit cards. There are a lot of credit card processing companies that only offer interchange plus pricing.

*SRC – Wikipedia

What Is PCI / DSS Compliance?

PCI-DSS, also called PCI Compliance or just “PCI,” stands for Payment Card Industry Data Security Standards. Secure transactions are important for merchants and a key element of the customer service Host Merchant Services provides. As part of our commitment to our merchants and their transaction security, HMS offers a PCI Compliance service included with all merchant accounts. Host Merchant Services never charges non-compliance fees or annual PCI compliance fees.

Host Merchant Services PCI Compliance Solutions – every account includes:

PCI Compliance assessment survey through a simple web Interface

Live support provided by our PCI Helpdesk to make compliance a breeze

All required PCI Compliance network scans.

Comprehensive, step-by-step assistance for all aspects of the PCI Compliance process

If PCI Compliance is a headache for your business, or if you are frustrated by high fees and non-compliance charges, switch to Host Merchant Services for a partner you can rely on to help you feel confident with data security and PCI-DSS Compliance.

What Is EBT?

Electronic Benefits Transfer (EBT) is the system that the government uses to provide benefits to low-income households. Funds are transferred onto an EBT card much like a direct deposit into a bank account with a check card. The EBT card can then be used at authorized businesses to purchase food and other commodities that are approved by the government. Approved retailers are able to accept EBT card payments from customers the same as they would debit or credit cards. There is no difference for the merchant as the total purchase amount is transferred into the merchant’s bank just like any other electronic payment.

How Do I Get A Free EBT Terminal?

We proudly offer free terminals to all government registered EBT retail businesses. The process is easy! If you are a new customer to Host Merchant Services, give us a call, supply your FNS number (your EBT retailer ID), and we’ll set up an account for you. Within a few days of signup, we’ll ship your free terminal! Once you receive your free EBT terminal, all you have to do is plug it in and you’re ready to go! Don’t have an FNS Number? Use the link in the section below to register for the EBT (SNAP) program. Once registered you will receive an FNS number.

If you already have an account with us, simply call us and supply your unique FNS number and we take care of the rest. We will add EBT to your processing system and within 2-3 business days, you will be able to accept EBT payments!

What is a CVV number?

CVV stands for “Card Verification Value” and is a security feature found on most credit and debit cards. The CVV is a three or four-digit security code printed on credit and debit cards. The code is used as an added security measure for card-not-present transactions – such as an online or telephone-based payment. For card-present transactions, the CVV is not used. Since CVV was introduced, it has helped to greatly reduce incidents of online, phone, and mail order credit card fraud.

Where is the CVV located on a card?

A card’s CVV, which stands for “Card Verification Value”, is a special code printed on credit and debit cards. This code is used as an extra layer of security and protects against fraud and is usually a 3 digit code printed on the back of the card next to the signature strip. Though the CVV is usually located on the back of the card, it is not always. American Express® cards generally have the CVV in the form of a 4 digit number on the front of the card just above and to the right of the card account number. No matter what card you have the CVV will be in one of these locations. The graphic below shows both for visual reference.

Is a card CVV the same as the PIN?

No.Though both CVV and PIN numbers both add a layer of security to transactions they are not the same thing. CVVs are used for online and phone orders whereas PIN is used for in-person transactions where the cardholder is physically swiping or dipping their card.

Current US Interchange Rates (Visa, MasterCard)

The term “Interchange rate” refers to the fees charged by the card companies for use of their cards. These card companies include Visa, Mastercard, AMEX, Discover. Interchange rates change twice a year – in April and October. Payment processing companies make money by putting a markup on top of the interchange rate. This is called cost-plus or interchange-plus pricing. “Interchange” is the card company rate and the “plus” is the markup by the payment processor. The interchange-plus pricing structure has the lowest rates compared to all other pricing structures, including tiered and flat-rate pricing which can be much more expensive.

Common Visa and MasterCard Interchange Rates

| Card Type | Interchange Rate |

|---|---|

| Visa Debit CPS | 0.80% + 15¢ |

| Visa Debit CPS Regulated | 0.05% + 22¢ |

| MasterCard Debit | 1.05% + 22¢ |

| MasterCard Debit Regulated | 0.05% + 22¢ |

| Visa Credit CPS Retail | 1.51% + 10¢ |

| MasterCard Credit Consumer (Merit III Core) | 1.58% + 10¢ |

Current Discover Interchange Rates

When you open a merchant account with us you get the ability to accept Discover cards. Discover is a major credit card brand in the US. Other major credit cards include Visa, MasterCard, and American Express. Discover cardholder demographics tend to be younger, making this payment method important to cater to younger consumers. Discover cards are not accepted by every merchant meaning accepting Discover increases your businesses value to Discover cardholders.

Common Discover Card Interchange Rates

| Card Present – Discover Debit | Interchange Rate |

|---|---|

| Discover Debit | 1.10% + $0.16 |

| Discover Debit Regulated | 0.05% + $0.22 |

Current American Express Opt Blue Rates

OptBlue is a program started by American Express (Amex) to offer an affordable way for small businesses to accept their cards. To be able to use the OptBlue program, the business must process less than $1 million dollars in American Express cards each year.

Before OptBlue, small businesses had much higher processing fees for Amex cards. Because the rates were so high, many businesses chose not to accept American Express cards – leading to the new more afordable OptBlue pricing for small businesses. Many American express cards are used by businesses and corporations and are usually used for larger transactions. Reducing the rates for small businesses makes them much more likely to accept Amex.

American Express OptBlue Wholesale Discount Rates

| Description | Transaction Size | Rate |

|---|---|---|

| AMEX RETAIL | < $75 | 1.60 % + 10¢ |

| AMEX RETAIL | < $1,000 | 1.95 % + 10¢ |

| AMEX RETAIL | > $1,000 | 2.40 % + 10¢ |

| AMEX SERVICES | < $400 | 1.60 % + 10¢ |

| AMEX SERVICES | < $3,000 | 1.95 % + 10¢ |

| AMEX SERVICES | > $3,000 | 2.40 % + 10¢ |

| AMEX RESTAURANT | < $25 | 1.85 % + 10¢ |

| AMEX RESTAURANT | < $150 | 2.45 % + 10¢ |

| AMEX RESTAURANT | > $150 | 2.75 % + 10¢ |

| AMEX CATERERS | < $25 | 1.85 % + 10¢ |

| AMEX CATERERS | < $150 | 2.45 % + 10¢ |

| AMEX CATERERS | > $150 | 2.75 % + 10¢ |

| AMEX MAIL ORDER & INTERN | < $150 | 1.70 % + 10¢ |

| AMEX MAIL ORDER & INTERN | < $3,000 | 2.05 % + 10¢ |

| AMEX MAIL ORDER & INTERN | > $3,000 | 2.50 % + 10¢ |

| AMEX HEALTHCARE | < $150 | 1.55 % + 10¢ |

| AMEX HEALTHCARE | < $2,000 | 1.85 % + 10¢ |

| AMEX HEALTHCARE | > $2,000 | 2.30 % + 10¢ |

| AMEX B2B/WHOLESALE | < $400 | 1.55 % + 10¢ |

| AMEX B2B/WHOLESALE | < $7,500 | 1.80 % + 10¢ |

| AMEX B2B/WHOLESALE | > $7,500 | 2.25 % + 10¢ |

| AMEX LODGING | < $100 | 2.25 % + 10¢ |

| AMEX LODGING | < $1,000 | 2.60 % + 10¢ |

| AMEX LODGING | > $1,000 | 3.00 % + 10¢ |

| AMEX T&E | < $100 | 2.25 % + 10¢ |

| AMEX T&E | < $1,000 | 2.60 % + 10¢ |

| AMEX T&E | > $1,000 | 3.00 % + 10¢ |

| AMEX PREPAID | < $75 | 1.35 % + 10¢ |

| AMEX PREPAID | < $1,000 | 1.70 % + 10¢ |

| AMEX PREPAID | > $1,000 | 2.15 % + 10¢ |

| AMEX OTHER | < $100 | 1.50 % + 10¢ |

| AMEX OTHER | < $3,000 | 1.85 % + 10¢ |

| AMEX OTHER | > $3,000 | 2.30 % + 10¢ |

What is a payment gateway?

A payment gateway is a service that securely transmits card information from an e-commerce website to the card payment network for processing then returns transaction information from the network back to the e-commerce website. A payment gateway works like a bridge or middleman between your website and your customer and it’s necessary to accept debit and credit card payments online or on mobile devices.

Once a customer places an online order, the payment gateway performs several steps to finalize the transaction:

Encryption. The browser encrypts card data while it’s sent back and forth between the web server. The payment gateway sends the data to the payment processor through the acquiring bank.

Authorization request. The payment processor sends the data to the card association. The card’s issuing bank approves or denies the authorization request.

Order fulfillment. The processor sends an authorization to the payment gateway. The payment gateway transmits the response to the website to process the payment.

A payment gateway also performs other functions to screen out as much fraud as possible. This is important as online payments have a much higher risk of fraud than card-present transactions. A payment gateway may offer fraud prevention tools like:

Geolocation. This tool checks the IP geolocation of the customer’s device against the shipping or billing address.

Delivery address verification. This tool verifies the provided address and corrects invalid city, state, and ZIP code combinations in real time. It can improve fraud detection and avoid shipment misrouting.

AVS check. The Address Verification System (AVS) verifies the billing address on the card matches the address provided by the customer.

Payment Gateway vs Payment Processor

In any credit card transaction, there are four parties involved: the merchant, the customer, the acquiring bank that provides merchant services, and the issuing bank that issues the customer’s card.

The payment processor is responsible for executing transactions by transmitting data between the merchant, the issuing bank, and the acquiring bank. A payment processor may also provide point of sale technology and credit card machines.

The payment gateway is responsible for securely transmitting online payment information to the payment processor to continue the transaction. A payment gateway works like an online POS terminal.

Supported Payment Gateways

Processing transactions reliably and securely is essential to your business. Authorize.Net, the leading Internet Protocol (IP) based payment gateway, provides solutions you can trust.

More than 136,000 merchants depend on us to process their transactions, assist in the prevention of fraud, and help their business grow. We offer a wide range of services and tools to enhance your business and increase your revenues, regardless of your business model — Web, retail, mail order/telephone order (MOTO) or mobile.

How Do Payment Gateways Work?

A payment gateway facilitates the secure transfer of information between a payment portal (such as a website, mobile phone) and the Front End Processor or acquiring bank.

What is a merchant cash advance?

A merchant cash advance is funding based on the volume of your total credit card sales. Either your credit card processor or a third-party lender advances your business money, which the lender then takes from your future credit card sales as a percentage.

Rather than borrowing money via a traditional loan, your business can borrow against its future by “repaying” the advance by way of automatic deductions from credit card sales. Because small and medium-sized businesses experience challenges securing capital, a cash advance is a solution to help sustain businesses, as well as to help businesses grow.

Why would my business need a merchant cash advance?

Top 5 Reasons to Get a Merchant Cash Advance

1. They are Fast and Easy.

The hardest part about applying for a merchant cash advance is finding the right provider. It’s important you find a provider that is not only reputable but also offers flexible payment options. To make this search fast and easy, as promised, use Global 1 Wholesale Merchant Services. Global 1 Wholesale Merchant Services will find the cash advance partner that fits you best so you won’t have to waste time searching.

All you have to do is fill out a quick application. Global 1 Wholesale Merchant Services will then find the perfect solution that best fit your needs. Each offer is explained in detail and we will help you choose the right advance for your business. Once you accept the advance, Global 1 Wholesale Merchant Services can get you your working capital in as little as 24 hours! Compare this to the months it often takes to even have your application reviewed for a traditional business loan.

2. There is No Collateral Needed

If you’re looking for a business loan from a bank, you’ll be required to provide collateral. For many people, this ends up being their home. If something should happen and you’re unable to repay the loan, in that instance, you could lose your house.

Merchant cash advances are different. They are unsecured and not technically a loan, so you don’t need collateral. Therefore, there is no fear of losing your home or any of your business assets.

3. There are Flexible Payment Options

Many merchant cash advances offer flexible payment options that allow you to choose how to pay it. Some of these options include daily and weekly ACH payments.

Traditional business loans from a bank require you to pay one fixed amount every month. These come with high fees and no consideration for your sales or business. Merchant cash advances are based on a fixed percentage of your sales. So, if your sales are down one month, you won’t have to scramble to try and make some ballooned bank payment.

4. You Can Use Your Money How You Want

Merchant cash advances provide the ultimate flexibility in how you spend your money. Many business owners who do get approved for business loans, quickly find out that the bank strictly controls how you can spend it. When Global 1 Wholesale Merchant Services finds the right provider for you, you can be assured that you will be allowed to spend your money how you see fit.

Global 1 Wholesale Merchant Services believes that every business should have complete control of their cash flow. You’re looking for business funding and we’re here to provide it to you with no hassle and no restrictions.

5. No Credit Checks

A major factor weighing on the minds of many small business owners is their credit score. Even if you have fair or good credit, oftentimes, it’s not good enough to get the loan you need. With merchant cash advances, there are no credit checks. Getting the cash flow you need will not affect your credit either.

Since merchant cash advance companies are not concerned about your personal credit history or your old financial records, you don’t have to waste time finding them. It can take a huge burden off your shoulders!

As you can see, getting the business funding you need can be done quickly, easily, and with no collateral or credit checks! You can fill out a simple application with Global 1 Wholesale Merchant Services and they will find the perfect provider options for you. Go over those options together and once you accept that you can have the cash you need in as little as 24 hours!

What are you waiting for? Don’t waste any more time waiting on banks who don’t have your business’s best interest at heart. Use Global 1 Wholesale Merchant Services today and get a quick and easy merchant cash advance without worry or hassle, contact us now.

Still have questions?

Call us, 24/7/365 and one of our specialists will be happy to help.